What is MindBridge?

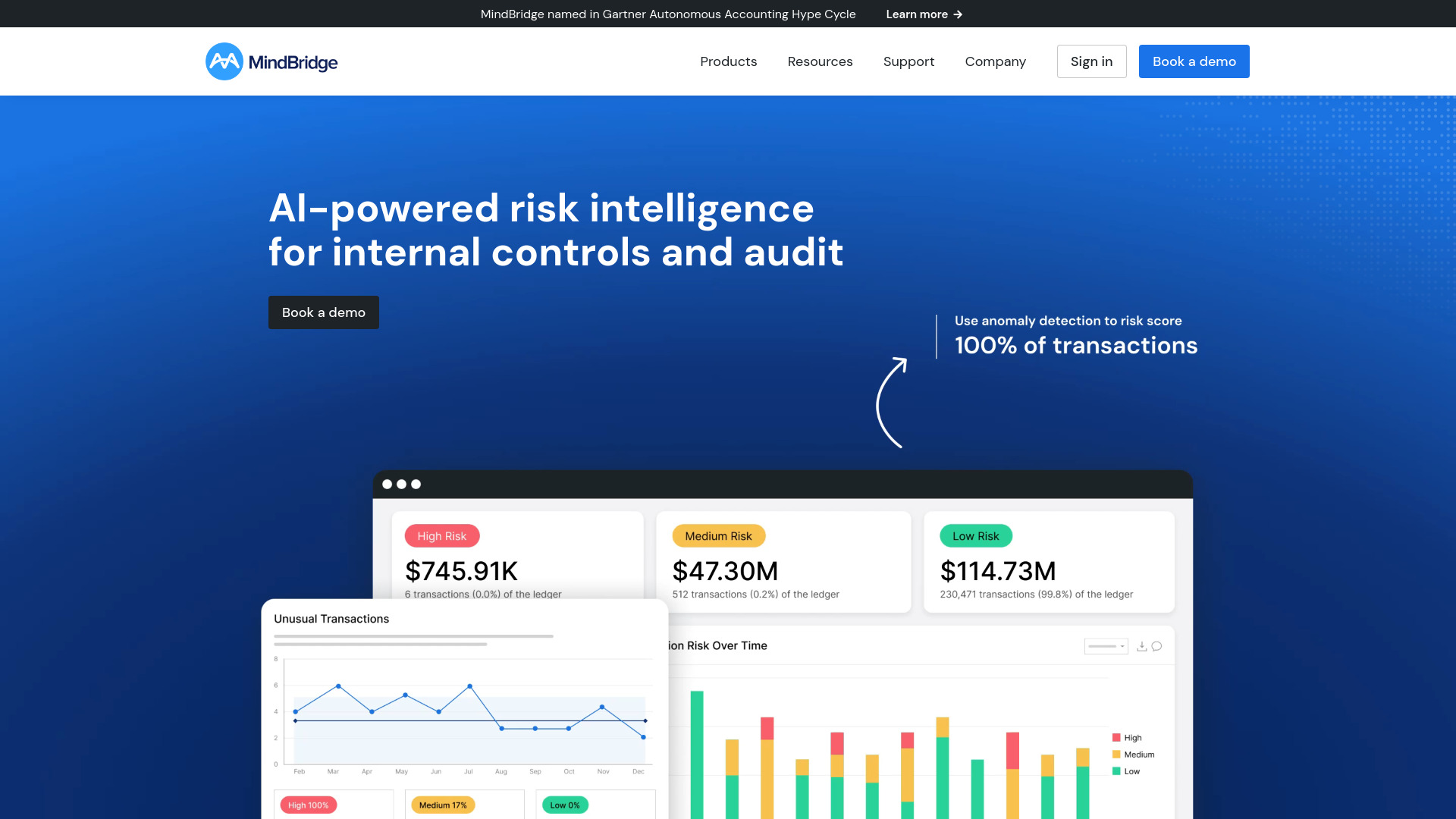

MindBridge is an AI-driven platform designed for financial professionals to revolutionize risk discovery and anomaly detection. This sophisticated tool leverages advanced machine learning algorithms to uncover hidden risks and anomalies in financial data that might otherwise go unnoticed. Positioned as an essential solution for risk managers, compliance officers, and financial auditors, MindBridge streamlines the risk assessment process, enabling users to make informed decisions with greater confidence and ensure financial operations remain secure and compliant.

How to use MindBridge?

Using MindBridge is straightforward and efficient. First, upload your financial data through the secure platform interface. The system automatically processes and analyzes the data using proprietary AI algorithms. Within minutes, you'll receive detailed insights highlighting potential risks and anomalies. The platform generates comprehensive reports that can be customized and shared with stakeholders. Regular users can set up automated monitoring for continuous risk assessment, while new users can access guided tutorials to maximize the platform's capabilities.

Core features of MindBridge?

- Automated data analysis: Processes vast amounts of financial data quickly and accurately, identifying patterns and potential issues that might be missed by manual review.

- Robust anomaly detection: Utilizes machine learning to detect unusual transactions, suspicious activities, and potential fraud with high precision.

- Comprehensive reporting: Generates detailed, customizable reports that provide clear insights and actionable recommendations for risk mitigation.

- Real-time monitoring: Continuously scans financial data for emerging risks, providing instant alerts when anomalies are detected.

- Integration capabilities: Seamlessly connects with existing financial systems and data sources for streamlined workflow and comprehensive analysis.